Affordable Housing

Consultation has concluded

Affordable housing is a topic of concern across the nation, regionally and locally. Property values and rents have been increasing at far faster rates than wages. This growing gap between what it costs to live and what people are able to earn is redefining who is economically struggling or impoverished in our community. Increasingly, the people in our community who need help, who are food insecure and a car repair or unexpected medical expense away from homelessness are working, mid-level professionals.

Consider the young professional earning $17.00 per hour or $35,000 per year. After taxes, this works out to approximatelyContinue reading

Affordable housing is a topic of concern across the nation, regionally and locally. Property values and rents have been increasing at far faster rates than wages. This growing gap between what it costs to live and what people are able to earn is redefining who is economically struggling or impoverished in our community. Increasingly, the people in our community who need help, who are food insecure and a car repair or unexpected medical expense away from homelessness are working, mid-level professionals.

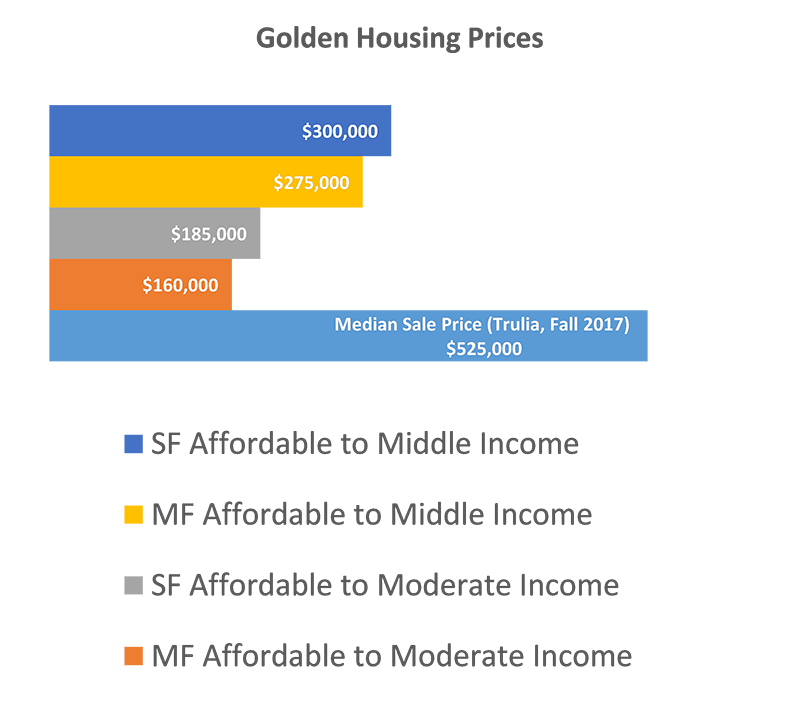

Consider the young professional earning $17.00 per hour or $35,000 per year. After taxes, this works out to approximately $80 in income per day. The 2016 median rent in Golden was $2,100 or $70 per day. This leaves $10 per day, or $300 per month, for everything else – food, transportation, medical expenses, insurance, child care and education, clothing, personal necessities, etc.

What about the slightly older professional or young professional couple who earn $55,000 per year? That works out to roughly $115 per day. After $70 per day for housing, that leaves this family with $45 per day or $1,350 per month for everything else.

This economic vulnerability is what thousands of Golden residents face each day, in addition to the roughly 2,000 children and 500 seniors who live below the federal poverty limit.

The high cost of housing in our community and region means:

- If you own an home and choose to sell it, you may see a significant profit on your original purchase price

- If you rent a home, rent payments take up an increasingly large percentage of your income, forcing tradeoffs with other necessities such as food, medical care and transportation

- If you are a senior with a moderate income in retirement who has lived in your home for some time, finding a smaller, lower maintenance home that is within your budget may be challenging

- If you have special needs and limited income as a result, there is very little housing, either independent or assisted living, available to you and waitlists for subsidized housing are years long.

- If you are a young professional, it will be a challenge to save enough for a down payment, given the high cost of renting, and find a home to purchase much less stay in the rental market

- If you have young children and have to move frequently to find the lowest cost housing, your children may face reduced educational achievements and increased health risks from your family’s housing instability

- If you grew up in Golden, you may find it difficult to remain in or near your community as a young adult

Let us know what affordable housing means for you, your family or your business.

-

Let's Talk About the 1% System and Affordable Housing!

Share Let's Talk About the 1% System and Affordable Housing! on Facebook Share Let's Talk About the 1% System and Affordable Housing! on Twitter Share Let's Talk About the 1% System and Affordable Housing! on Linkedin Email Let's Talk About the 1% System and Affordable Housing! linkCLOSED: This discussion has concluded.How Does Affordable Housing Happen?

Local governments have 3 types of "tools" available to address housing needs in their communities:

- Policies that establish community goals and values

- Funding to support programs that assist homebuyers and renters and projects to either acquire or build affordable housing

- Regulations that directly support, or at least do not hinder, the acquisition or creation of affordable housing

Golden relies upon private and non-profit agencies to either build new or preserve existing affordable housing in the city, in the absence of available, local housing funds.

- New affordable housing developments can take 2 to 5 years to receive all the necessary funding and development approvals, making it far more risky than market rate housing.

- Local governments can either add to or mitigate that risk via local regulations or funding.

- An unpredictable allocation schedule makes a new affordable housing development in Golden an unattractive risk to both affordable housing agencies as well as other state and local funders.

Why Do Regulations Matter?Affordable housing developments are much more complex and risky than market rate developments. They are subject to increased public scrutiny, they have multiple sources of debt and equity financing, each with their own rules, objectives and oversight, and they do not have the margins to support unforeseen cost increases. Timeliness and predictability throughout all phases of the development process are crucial to limiting wasteful costs and delivering a viable project.When it comes to regulations and affordable housing, there are two different strategies. One looks at regulations that can directly result in new affordable housing by requiring new development to include both market rate housing and affordable housing. This type of regulation needs to complement a funding program that acquires or preserves existing housing as affordable housingThe other strategy is to analyze existing regulations that might put an unnecessary burden on affordable housing projects unrelated to the qualitative review process. The industry term is "Removing regulatory barriers" and is something that state and federal grant funders expect local governments to inventory and address. A typical regulatory barrier is the length of time it takes to process a development review application. Some communities provide faster application review times for developments that meet important community objectives. The City of Golden has very efficient development review application times.Golden's does have residential growth limitations - the 1% system that limits the number of new residential units permitted each year to about 75 currently. Other communities with residential growth limits include some type of priority for housing that meets important community objectives, such as affordable housing or mixed use developments. The concept is to create an incentive, within a restrictive system, for the types of housing that meet adopted community objectives. Role of the 1% SystemSince the adoption of the 1% System in 1996, there has been flexibility included to favor certain types of projects, either by setting aside allocations, exempting them from the 1% system total or allowing borrowing from future years. Currently, the only priority in the 1% system is for housing built near a transit station. These developments are able to request borrowing allocations from future years in order to construct the housing units sooner than would be possible by waiting to accumulate enough allocations to proceed.

Role of the 1% SystemSince the adoption of the 1% System in 1996, there has been flexibility included to favor certain types of projects, either by setting aside allocations, exempting them from the 1% system total or allowing borrowing from future years. Currently, the only priority in the 1% system is for housing built near a transit station. These developments are able to request borrowing allocations from future years in order to construct the housing units sooner than would be possible by waiting to accumulate enough allocations to proceed.

Past & Current 1% System Preferences

Potential Options for Affordable Housing

1. Set Asides from 1% Total: - Pipeline allocations, 282 units (1996-2003)

1. Set Aside previously unused allocations in a dedicated pool - Hardship, 4 units (1997-2001)

- Moderate Income, first allocation period only, 0 units

2. Exempt from 1% total 2. Exempt from 1% Total:

- GURA Project, 72 units (1997-2002)

3. Early Start or Borrow from Future Years - Senior Housing, 36 units + 80 beds(1996-2014)

3. Early Start or Borrow from Next 4 Years for Transit Station Housing, 100 units (2013-2016)

Multifamily developments are allowed to "bank" or save up however many allocations they receive each year until enough have been received to begin construction. From an outside perspective, having an approved development project that has successfully undergone the review process but then has to wait an indeterminate period of time to begin construction is an example of a regulation that adds costs unrelated to improving the quality of the development.Golden's greatest opportunity to achieve its affordable housing goals lies in preserving its existing affordable housing stock. Given the 1% system, there will always be very limited opportunities for anyone to build new affordable housing. However, if a future affordable housing development were to be proposed, the competition with market rate allocations would make it difficult, if not impossible, for a new affordable housing project to happen in Golden given the uncertainty involved with an unpredictable construction start. For this reason, looking for options to create a priority within the existing system would enable us to effectively support a future new, approved and financed affordable housing opportunity.

Options For ConsiderationStaff has identified two options that could support future affordable housing development without violating the 1%, now 0.9%, annual residential growth limitation and a third option that could have the potential to exceed the overall 1% limitation. It is important to note that allowing affordable housing units to have a priority within the 1% system is not sufficient to enable an affordable housing development, it would only remove a critical barrier to a development that would be subject to a lengthy review and approval process.- Option 1 - Allow borrowing from future year's allocations, similar to transit developments. This would reduce the total number of allocations available to individuals wanting to build single homes, Accessory Dwelling Units (ADU's) or mult-family market rate developments.

- Option 2 - Create a dedicated pool for affordable housing units out of previously unused allocations. This would not reduce the number of future, market rate allocations.

- Option 3 - Exempt affordable housing units from the allocation process. This has the potential to eventually exceed the overall 1% limitation, but given the large number of previously unused allocations, the limited affordable vacant or redevelopable sites, and the difficulty of assembling the financing necessary for affordable housing development, it is highly unlikely that an exemption alone would be sufficient for a significant amount of affordable housing development. It could also create an incentive for affordable Accessory Dwelling Units (ADU's.)

* Because attached units cannot be reasonably built in partial buildings, the actual number of newly constructed homes each year can vary from the annual number of allocations assigned.

* Because attached units cannot be reasonably built in partial buildings, the actual number of newly constructed homes each year can vary from the annual number of allocations assigned.

-

Why is Housing Unaffordable?

Share Why is Housing Unaffordable? on Facebook Share Why is Housing Unaffordable? on Twitter Share Why is Housing Unaffordable? on Linkedin Email Why is Housing Unaffordable? linkCLOSED: This discussion has concluded.

-

How does Affordable Housing Happen?

Share How does Affordable Housing Happen? on Facebook Share How does Affordable Housing Happen? on Twitter Share How does Affordable Housing Happen? on Linkedin Email How does Affordable Housing Happen? linkCLOSED: This discussion has concluded.

Affordable housing is either bought from the existing housing stock or newly built. Long term or dedicated affordable housing is the result of someone paying to mitigate the difference between market prices and what is affordable to a low, moderate or middle income household. Usually, several different sources of equity and debt funds are necessary to successfully acquire and rehabilitate existing housing or construct new housing to be affordable. There are a variety of competitive federal programs that make available both equity and debt sources and some local communities also choose to make funding available to support affordable housing.

Affordable housing in a high cost market, such as Golden’s, means that there are rent or resale limits that keep the home affordable to a specific household income. Rent and resale restrictions are the tradeoff or result of the various equity and debt sources used to make the housing affordable to low, moderate or middle income households. Here are some examples of what this means for different types of programs:

· A qualified household can buy a home with a grant or loan that reduces the price to an affordable one and in return, must sell the home to another income qualified household for an affordable price.

· An agency can buy an existing apartment building with grants and loans and in return, rent the apartments to income qualified households for an affordable rent.

· A qualified low income household may receive a Housing Choice Voucher that helps them to rent certain market rate apartments by paying a portion of their monthly rent.

· An agency that constructs multifamily rental housing may receive Low Income Housing Tax Credits and loans to build new apartment buildings and in return, rent the apartments to income qualified households for an affordable rent.

· An agency that constructs for-sale housing may receive grants or loans to produce housing that sells for affordable prices to income qualified households. In return, those homes continue to be re-sold to qualified household for an affordable price.

· Some communities require that a portion of certain new residential developments be dedicated affordable units. There may be grants available to help with this or the developer alone is required to subsidize these units with the profits from the market rate units.

Who pays? Subsidies for affordable housing ultimately come from community members in the form of taxes, fees or prices. The largest source of subsidy for newly constructed rental units is the Low Income Housing Tax Credit program. The Department of Housing and Urban Development (HUD) has a variety of grant programs to help subsidize the cost of acquiring or building affordable housing and state housing finance agencies can help with below market financing. Most affordable housing projects, whether it involves buying existing housing or building it new, requires multiple equity and below market debt sources to make it financially viable.

It is important to note that in addition to federal tax credits, the other significant source of housing grant funds come from the HOME Investment Partnership and some Community Development Block Grant (CCBG) funds. The amounts available under these and other federal block grant programs have been declining significantly over time.

Golden’s greatest opportunity to maintain and create affordable housing in the community is in helping low, moderate and middle income households to purchase or rent its existing housing.

3 comments

3 comments

-

What does "Affordable Housing" mean?

Share What does "Affordable Housing" mean? on Facebook Share What does "Affordable Housing" mean? on Twitter Share What does "Affordable Housing" mean? on Linkedin Email What does "Affordable Housing" mean? linkCLOSED: This discussion has concluded.

“Affordable” means a household pays no more than 30% of their gross income for a housing payment.

Þ Rent + Utilities or

Þ Mortgage + Utilities

Key Links

- City of Golden Housing and Rental Assistance Resources

- Grant of up to 3% of mortgage amount available statewide in conjunction with CHFA mortgage

- DOLA Housing Resources

- 2018 Housing Unaffordability Report & Interactive Tool

- Urban Institute - Explore the Cost of Developing New Rental Housing

- How Much do you Need to Earn to Afford a Modest Apartment in Your State? The Annual Out of Reach Report

- Attainable Housing

Quick Facts

Did you know that...

· . . . 3 out 4 surveyed metro area persons who are homeless are employed?

· . . . $23.50 is the hourly wage (or ~ $50,000 per year) needed to afford a 2-bedroom apartment in Golden at the Fair Market Rent (calculated at the 40th percentile all market rents)?

· . . .there is no state where a person working full time at the federal minimum wage can afford a 2-bedroom apartment at the Fair Market Rent?

· . . . for every Jefferson County Housing Authority or non-profit agency affordable apartment, there are at least 5 households on the waitlist?

· . . . manufactured homes are taxed and sold as personal, not real property, and as a result, the loans to purchase one have higher interest rates than a standard real estate mortgage?

· . . . Golden’s existing housing stock is roughly half detached single family and half attached or multi-family?

· . . . since 2000, Golden’s average annual residential growth rate was 0.8%, Jeffco’s was 0.7% and Colorado’s was 1.8%?

· . . . given Golden’s rents, it can cost a typical retail worker 2 to 3 months of earnings just to pay the first and last month’s rent, deposit and fees needed to move into an apartment?

· . . .in Colorado, nearly 25,000 children were homeless during the 2014-2015 school year, despite a recent decline in children living in poverty? (Most live in vehicles or overcrowded housing.)

· . . . the living wage for 2 working parents with one child in Jefferson County is $15.00 each, while the minimum wage is $8.30?

Photos

Engagement Level

- Inform: City provides timely information and updates to the community.

- Consult: Hear public feedback on relevant parts of a project, keep information updated so community can follow along.

Who's listening

-

Email rmuriby@cityofgolden.net

3 comments

3 comments